Upload your CV

Upload your CV to our database.

Please let us know where you are, or where you would like to be in the world so we can point you in the right direction.

Contractors often have questions about how to work via your own Personal Service Company (PSC), what you need when working through an umbrella company or how to use Salt’s timesheets. To help you find answers quickly, we’ve put together this list of frequently asked questions for contracting. If you have a question that we haven’t answered or if you would like more information, please get in touch with our team.

You’ve just secured a work opportunity outside of your home country as a contractor. You’re excited to get going, but may also be feeling overwhelmed with the onboarding process. You may even find the local labour, social security and tax laws are confusing. It can seem a little daunting if you have never worked outside your home country but provided you work via an approved local solution that ensures all social security and local taxes are accounted for, your onboarding should be a pleasant experience. We’ve put together a few questions you may have to make the process a bit easier for you (last updated January 2021).

Generally speaking, you must be registered in your work country. When you move your contracting activities to a different country, you may have to pay taxes where that work is done.

You must ensure that you are complying with local laws surrounding taxes and social security so please familiarize yourself with these laws or get in touch with one of our approved umbrella companies/payroll providers who can assist you further.

There may be some circumstances where you can use your UK limited company if you will be completing a lot of work remotely in the UK with occasional travel to another country. In this scenario, you will be required to obtain an A1 form.

An A1 form certifies which social security legislation applies to the holder of the form and is needed if you have a connection through your employment or self-employment with more than one EU country. There may be other factors to think about, so contact our Compliance team if you need more info.

When working outside your home country, various umbrella companies (also known as management companies) will have specialist knowledge of the laws in that country. They can help you with the paperwork you’ll need to qualify to work compliantly. For example, they may be able to help with visa sponsorship. They can also help with tax requirements as there are different rules for registration, tax returns and tax relief in each country. There are fees involved, but many contractors find the use of an umbrella or payroll provider worthwhile and are happy to engage with them to relieve the administrative burden.

From the get-go, make your sales consultant aware of your desired take home after deductions. This will enable our consultant to negotiate an appealing day rate with the client and liaise with the payroll partner who will be able to estimate how much you will retain after relevant deductions are made. If you would like us to share our preferred suppliers with you, please email contract@welovesalt.com.

We will only work with payroll providers on our approved supplier list as they have been thoroughly vetted to ensure compliance. The decision to only work with approved umbrella companies is related to Salt’s increased exposure to various legal/tax risks.

Following the introduction of the Criminal Finances Act 2017, recruitment companies are not only exposed to the possibility of paying civil or administrative fines but also face the risk of being criminally prosecuted where they fail to implement reasonable prevention measures or aid the facilitation of tax evasion in any way.

We are not in a position to do so but our payroll providers may provide you with useful tips so do tap into their local knowledge. They can refer you a housing website if you are having trouble finding accommodation.

Netherlands

In the Netherlands, there is a strict concept of chain liability which means that everyone in the chain (end hirer, recruitment agency and the contractor) can be held accountable if a contractor does not pay his/her (employment) taxes.

Due to the complexity of the relevant legislation, we leave it up to our umbrella and payroll partners to determine your tax status (employed or self-employed) and pay you accordingly. This is the only model we operate for assignments in the Netherlands.

Your payroll provider will then decide whether you will work as ’employee’ via a (collective) labour agreement or ‘independent contractor’ under the current DBA rules (Deregulation Assessment Working Relations Act).

Germany

We can onboard setups like German sole traders (‘Freiberufler’) and contractors who work via their GmbH if a contractor provides services in Germany. The client will need to confirm whether the nature of assignment and services to be delivered makes you, the contractor, an independent service provider. This assessment must be completed before you can be engaged as a self-employed contractor.

You will need to provide us with a passport, Commercial Register Extract and Certificate of Registration of VAT (if registered), tax number, Public Liability and Professional Indemnity insurance, health insurance and a bank statement of the business bank account. If you need an in-depth description about specific compliance please contact contract@welovesalt.com.

Belgium

We can onboard setups like Belgian sole traders (‘eenmanszaak’) or local equivalents of UK Limited companies (e.g. the Belgian BV/SPRL) if a contractor provides services in Belgium. You will need to provide us with a Limosa (when applicable), passport/visa, company number and Certificate of Registration of VAT (if registered), Public Liability, Professional Indemnity, health insurance paperwork, a bank statement of company business bank account and proof of registration with Social Insurance Fund or National Aid Fund.

Please ensure these documents are sent to us before your assignment start date. The client will confirm whether you are a contractor employee or sole trader. If you have a specialist skill set and will carry out the work independently, you are likely to be engaged as self-employed. You can apply for a Limosa through accessing International Socialsecurity. This is very easy to obtain and free so don’t overlook this as it could expose you to criminal penalties.

Umbrella companies can process payment into whatever account you supply but the pros of opening an account in local currency are that bank costs are eliminated and payment will be received sooner.

Therefore, we would recommend setting up a bank account that operates in the currency that you will be paid in. Should you choose to utilise a GBP account and receive payment in Euros, for instance, your bank will most like charge a conversion fee.

There are many variables to consider so do some research and count the cost. You will need to seek legal advice and hire a local accountant meaning there will be time, expense and paperwork involved. You will also need to take into account the length of your assignment and how long your plan to live there. Salt has partnered up with trusted payroll provider companies who are happy to help you further.

Many contractors prefer to operate through their own PSC/ UK limited company. However, it is best to seek professional advice from an accountant or a legal advisor before you decide to set up a PSC. Running your own business gives you control of your finances but may be time-consuming, increase your admin burden and expose you to added risk.

Salt has a good network of accountancy providers who can help you with setting up a limited company in a matter of hours. These providers can help with getting your accounts set up online, managing your book-keeping, assisting with tax issues, and ensuring you stay compliant. Please get in touch with the Compliance and Contracts team for contact details of these accountancy providers.

You need to provide us with your certificate of incorporation, bank statement, VAT certificate (if VAT registered) and proof of Professional Indemnity and Public Liability Insurance. We will also ask for additional details like ID, National Insurance number and other documentation if requested by our client. Rest assured that your personal data will be protected under GDPR. If you have any privacy concerns, please contact our Data Protection Officer using GDPR@welovesalt.com.

Our Compliance and Contracts team needs to check if your PSC is the valid account holder of the business bank account which you have supplied for us to process payments into for the duration of your assignment. We are not interested in your balance so please feel free to redact this information. Alternatively, you can send us an opening letter from your bank.

To ensure that your business is protected financially and that you are complying with the requirements of our clients, all our PSC contractors will be required to have suitable insurance (£1 million coverage for both Professional Indemnity and Public Liability) in place. If your actions lead to anything being damaged (for example as a result of transmitting a virus) or anybody being injured it is essential that your company is insured, as it may result in a costly claim being made against your business. Likewise, if you give our client any advice or complete any work for them that leads to them losing money, they may bring a claim against you. In this situation, having insurance in place could be what keeps you in business.

This is a solution for contractors who do not want the hassle of running their own business, who are not keen to face any IR35 related risks and want legal certainty surrounding employment benefits like statutory sick pay for example. The umbrella company will employ you and make relevant deductions from your pay rate. We will pay your umbrella company, and they will pay you.

The payroll company market is saturated with non-compliant umbrella companies who may operate offshore payments and shady expenses policies. As a recruitment agency, we are exposed to fines and criminal prosecution if we facilitate tax evasion in any way. However, there is no need to fret as Salt have put together a list of approved umbrella companies who have been vetted by both Salt and/or accredited by recognised industry bodies. A list of approved umbrella companies can be found in your Salt Welcome Pack.

Email contract@welovesalt.com and we will advise you on the next steps. We are prepared to work with umbrella companies who are not on our Approved Supplier List, but all umbrella companies will need to be vetted before we can work with them. When considering an umbrella company please ensure they are FSCA accredited by checking the register on FCSA.

Identity documents, National Insurance number and referee contact details (when applicable). Your umbrella company will send across their company documents.

The following are some general timesheet related questions we often get asked. Click here to log into Intime.

Once the Compliance and Contracts team have received all your company documents, we will be able to complete your onboarding and grant you access to Intime.

Any live placements will only be visible to contractors from the start date of your assignment onwards. If your assignment has already started please speak to the Compliance and Contracts team.

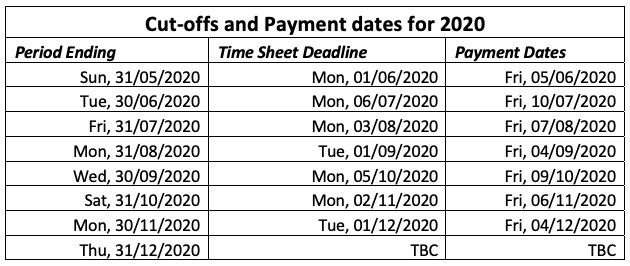

Please submit your timesheet at the end of each working week or each working month depending on your agreed timesheet frequency. Ensure this is completed no later than the following Monday to enable us to process your timesheet within our pay-run deadline. For example, if the last working day in April is 30/04/2020, your timesheet must be submitted and approved by 04/05/2020. Our pay-run deadline is always Monday close of business.

If your timesheet is approved before our deadline, your company will receive payment by close of business on Friday of the same week. Please note payment will be one week in arrears.

Expenses will only be processed upon approval from the client. Please submit expenses to our Contractor Payments Manager with accompanying receipts using Salt’s expenses form unless otherwise agreed. More information is outlined in your Salt welcome pack.

Yes, please also complete your timesheet on Intime to enable us to process your payment. For simplicity, you can upload a screenshot of your approved timesheet from the client’s portal and email this to paymentqueries@welovesalt.com.

We frequently receive questions around payment dates for those of you on a monthly invoicing frequency. Whilst the last working day of each month differs from month to month, our timesheet deadline is always the following Monday after the timesheet cycle is complete. Given your timesheet is submitted and approved by close of business on that Monday, your umbrella or limited company will receive funds in the same calendar week. We’ve included some dates below for the rest of the calendar year and hope this provides some clarity.

If we pay your umbrella company, please liaise with them on exactly when they will pay you once they have received funds from us.

December

Our timesheet and payment deadlines will be structured slightly differently in December due to the festive bank holidays and we will confirm a breakdown of this nearer to the time.

Please contact our Compliance and Contracts team on contract@welovesalt.com where someone will respond to your query or give you a call back.

Please get in touch with our Contractor Payments Manager on paymentqueries@welovesalt.com

Upload your CV to our database.

Please let us know where you are, or where you would like to be in the world so we can point you in the right direction.